Are you a financial advisor looking to enhance retirement planning for your clients? Look no further than Human Interest’s intuitive interface. With its easy-to-use dashboard, Financial Advisors across the country can deliver customized retirement plans to their clients. The platform allows for the creation of investment lineups from a wide range of mutual funds and low-cost index funds, or participants can choose from individualized model portfolios. Human Interest has disrupted the industry by offering zero transaction fees, making retirement planning more accessible and affordable. By partnering with Human Interest, Financial Advisors can provide their clients with a seamless and efficient retirement planning experience.

Enhancing Retirement Planning

Role of Financial Advisors

Financial advisors play a critical role in guiding their clients through the complexities of retirement planning. They are tasked with understanding individual financial situations and helping clients set realistic retirement goals. Advisors must evaluate various investment options and develop strategies that match the risk tolerance and time horizon of each client. They also provide ongoing advice and adjustments to retirement plans, ensuring clients stay on track to meet their goals. With regulations and market conditions constantly changing, a financial advisor’s expertise is invaluable in navigating these shifts. In essence, financial advisors are not just planners; they are educators, coaches, and, often, the peace of mind that clients need when planning for their future. Partnering with Human Interest allows financial advisors to leverage technology to enhance these services and deliver more effective retirement planning solutions.

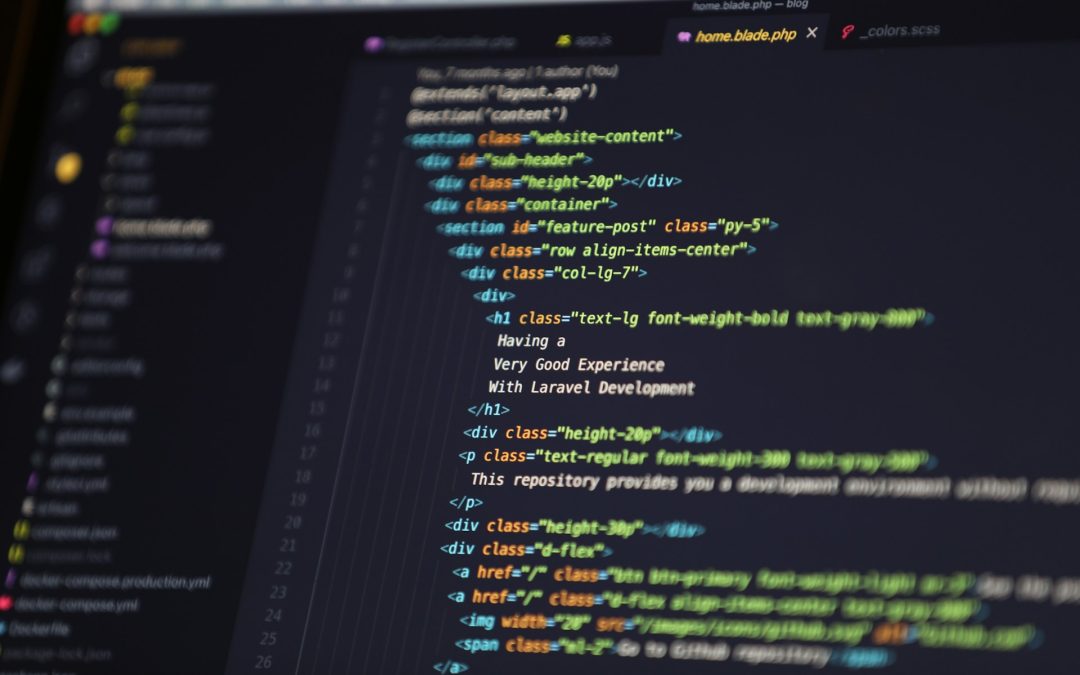

Human Interest’s Intuitive Interface

Human Interest’s platform is designed with a focus on simplicity and user-friendliness, ensuring that financial advisors can manage retirement plans efficiently. The intuitive interface streamlines the process of account setup, client onboarding, and portfolio management. Advisors can easily select investment options, adjust plan features, and monitor the performance of their clients’ portfolios in real time. The dashboard provides a clear overview of all necessary information, making it easier to identify opportunities for optimization. This ease of use extends to plan participants as well, who benefit from a straightforward experience when reviewing their investments and making changes. By reducing the friction in managing retirement plans, Human Interest’s interface empowers financial advisors to focus more on strategic advice and less on administrative tasks.

Custom Retirement Plans with Human Interest

Customization is key in retirement planning, and Human Interest’s platform excels at providing tailored solutions. Financial advisors can create personalized investment lineups that cater to the unique needs and goals of each client. With access to a diverse range of mutual funds and low-cost index funds, advisors can construct portfolios that strike the right balance between risk and return. Additionally, clients who prefer not to actively manage their investments can opt for model portfolios that are automatically adjusted based on their retirement horizon. Human Interest’s tools also allow for easy adjustments as clients’ financial situations evolve. This level of customization ensures that clients feel their retirement plan is truly theirs, fitting their specific life circumstances and providing a clear path toward their retirement goals. With Human Interest, advisors can deliver a bespoke retirement planning experience that stands out in today’s crowded market.

Advantages of 401(k) for Businesses

Offering a 401(k) plan is a strategic move for businesses seeking to attract and retain top talent. A robust retirement plan signals to current and prospective employees that a company cares about their long-term financial well-being. Beyond the benefit to employees, businesses can leverage tax advantages. Contributions made by the company are typically tax-deductible, reducing the overall tax burden. Additionally, businesses may be eligible for tax credits to offset the costs of setting up and administering the plan. Human Interest’s platform simplifies the management of 401(k) plans, making it more feasible for small and medium-sized businesses to offer competitive benefits. The ease of administration through Human Interest’s interface can also lead to cost savings on plan management, allowing businesses to invest more in their employees’ futures.

How Business Partnerships Enhance our Service

Collaborating with businesses is a cornerstone of Human Interest’s approach to offering superior retirement planning services. Through partnerships, we gain insights into the specific needs of different industries and company sizes, allowing us to refine and customize our platform. These collaborations help us understand the challenges businesses face when providing retirement benefits, leading to enhancements that make our service more responsive and effective. By working closely with companies, we also ensure that our platform remains compliant with changing regulations, reducing the administrative burden on businesses. Furthermore, these partnerships often lead to innovative features and tools that make retirement planning more engaging for employees. The feedback we receive from our business partners is invaluable; it drives continuous improvement and helps us maintain our commitment to delivering a user-friendly and efficient retirement planning experience for financial advisors and their clients.

Unique Offerings of Human Interest’s 401(k)

Human Interest’s 401(k) stands out with its unique offerings designed to meet the needs of both employers and employees. One of the notable features is the zero transaction fees model, which makes it more cost-effective for participants and helps them maximize their savings. The platform also offers a flexible plan design, including traditional and Roth 401(k) options, which caters to the diverse financial situations of employees. Additionally, Human Interest provides automatic enrollment and escalation features, encouraging higher participation rates and savings levels. For employers, the ease of payroll integration reduces administrative workload and simplifies the process of plan management. With a commitment to transparency and a focus on low-cost index funds, Human Interest’s 401(k) is an attractive option for businesses looking to provide a valuable benefit to their employees without incurring exorbitant costs.

Our Journey to a Disruptive 401(k) Solution

Our journey to creating a disruptive 401(k) solution began with a clear vision: to make retirement planning accessible and affordable for all. Recognizing the complexity and high costs traditionally associated with retirement plans, we set out to design a solution that would remove these barriers. Through innovation and technology, we developed an intuitive platform that simplifies the retirement planning process. We focused on transparency, eliminating hidden fees, and providing a fee structure that is straightforward. By leveraging automation and smart design, we’ve made it easier for businesses to set up and maintain their retirement plans, and for employees to invest in their futures. Throughout our journey, we’ve listened to feedback from financial advisors, business owners, and plan participants, ensuring that our solution meets the evolving needs of the market. Our commitment to disruption drives continuous improvement, shaping the future of retirement planning.

Community Involvements and Future Plans

Human Interest’s commitment extends beyond offering retirement solutions; we are actively involved in the community, aiming to educate and empower individuals about financial wellness. We engage in workshops, seminars, and outreach programs that focus on the importance of early and effective retirement planning. Our future plans include expanding these educational initiatives to reach more communities, increasing awareness about the value of saving for retirement. Additionally, we are constantly exploring innovative ways to enhance our platform, including integrating advanced financial planning tools that can provide more personalized advice. We aspire to forge more partnerships with local businesses and community organizations, as these relationships are instrumental for understanding and addressing the unique financial needs of various groups. At Human Interest, we believe that by investing in the community, we are contributing to a future where everyone has the resources and knowledge to retire with dignity.